seattle payroll tax calculator

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Well do the math for youall you need to do is.

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

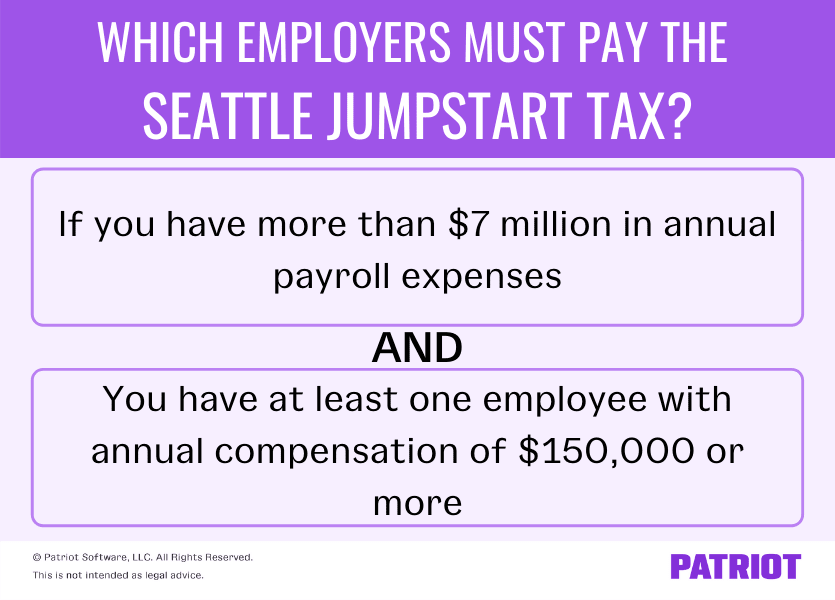

If you have more than 7 million in annual payroll expenses pay the tax on each employees wages over 150000.

. Payroll Expense Definition The. Ad Compare This Years Top 5 Free Payroll Software. After a few seconds you will be provided with a full.

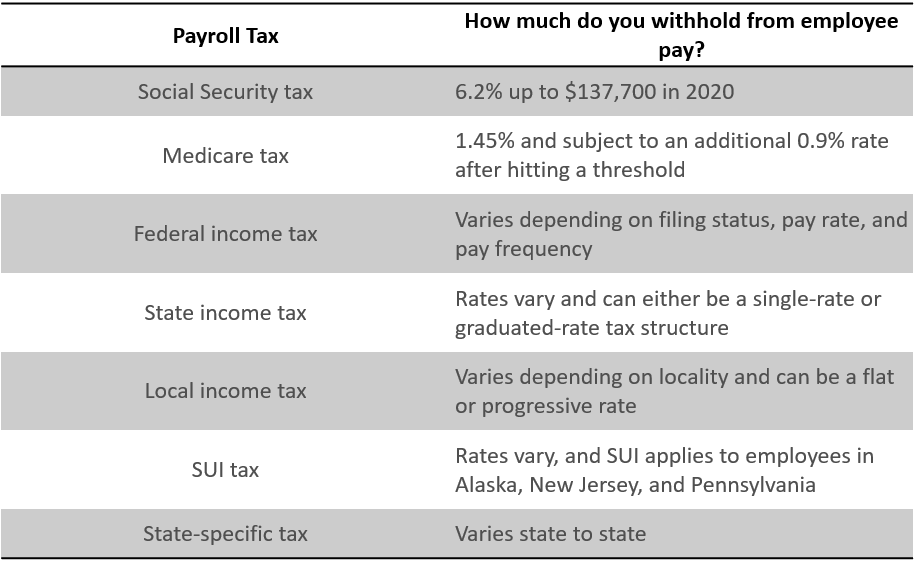

The payroll expense tax in 2022 is required of businesses with. Seattles Finance and Administrative Services Department FAS has released an updated payroll tax ruleThe administrative rule was updated because in April Seattle City. The rate is 6 of the first 7000 of each employees taxable income which means you wont pay more than 420 for each employee per year.

Easy-To-Use Online Invoice Software. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Washington. How to calculate annual income.

The City of Seattle Washington will impose a new employer-only Payroll Expense Tax effective 1 January 2021The filing of this tax was optional until Q4 2021and Zenefits is. However if you pay your FUTA. You can see a list of tax tables supported here with details on tax credits rates and thresholds used in the Salary Calculator Enter your salary or wages then choose the frequency at which.

While local sales taxes in Seattle Tacoma and some other metro areas are significantly higher than the national average. Use the paycheck calculator to figure out how much to put. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Get Started With ADP Payroll. The tax is levied on businesses and nonprofits with more than 7 million in Seattle employee payroll in the 2020 calendar year. Payroll Tax Salary Paycheck Calculator Washington Paycheck Calculator Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

The applicable tax rate is on a sliding scale from 07 to. Hourly Calculator Washington Washington Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the. A tax rate of 17 19 or 24 will apply on the payroll expense of Seattle employees with annual compensation of 400000 or more.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Your household income location filing status and number of personal.

So an employee that is compensated 300000year and spends 60 of their time working in Seattle would be subject to the tax at an applicable rate on 180000 of their annual. Discover Helpful Information And Resources On Taxes From AARP. Get Started With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years 10 Best Payroll Services Systems. For example if an employee earns 1500.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. Ad Process Payroll Faster Easier With ADP Payroll. 7386494 or more of payroll expense in Seattle for the past.

Free Unbiased Reviews Top Picks. Online Support for All Business Sizes. The tax applies to salaries more than 150000.

Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington. Free Unbiased Reviews Top Picks.

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

How Much Does A Small Business Pay In Taxes

Manual Payroll V S Automated Payroll What Type Of Payroll Processing Your Organization Prefers Briosconsulting Hiri Human Resources Payroll Software Payroll

Why The Challenge To Seattle S Payroll Tax Will Fail And Should Fail Post Alley

How To Calculate Food Cost With Calculator Wikihow

Tax Calculator Estimate Your Taxes And Refund For Free

Payroll Tax Specialist Salary Comparably

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

If You Need More Time To Complete Your 2017 Business Tax Return You Can Request An Extension Of Time To File Your Retu Tax Extension Business Tax Filing Taxes

Is A State With No Income Tax Like Washington Better Or Worse The Seattle Times

1 600 After Tax Us Breakdown July 2022 Incomeaftertax Com

If You Are A Business Owner In Seattle Wa And Have Questions About Seattle Or Washington State Sales Tax Contact Us Budget Planning Sales Tax Accounting Firms

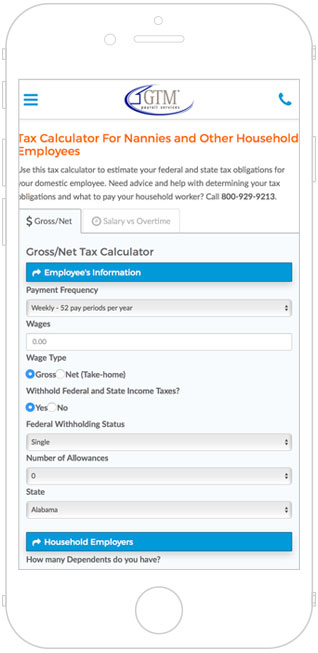

Nanny Tax Payroll Calculator Gtm Payroll Services

What Are Salary Taxes For Software Engineers In The Usa Quora

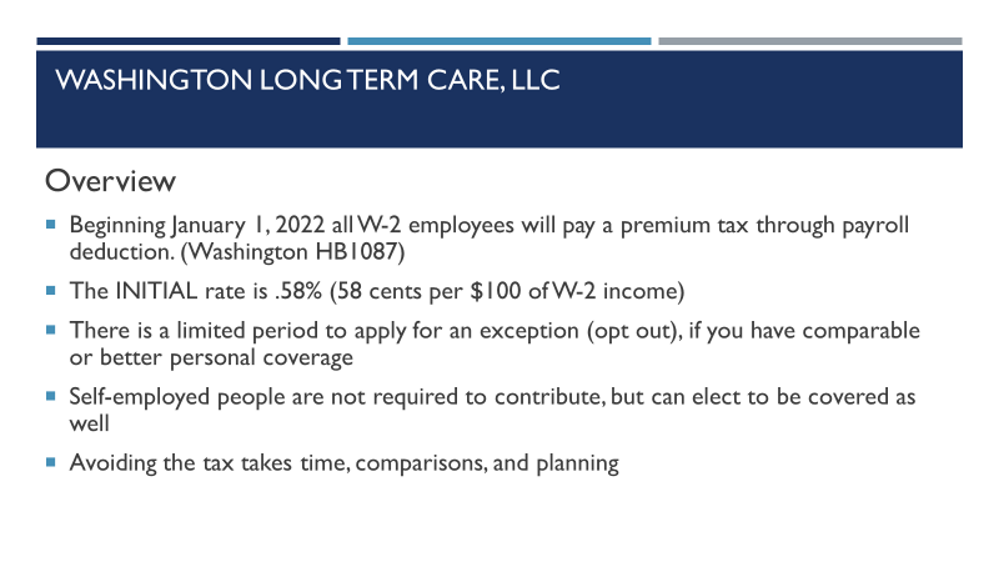

Payroll Washington Long Term Care Llc

Washington Paycheck Calculator Adp

Explore Our Sample Of Office Furniture Budget Template Budget Template Business Budget Template Budgeting

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll